Introducing TaxGraph

The taxation of multi-national companies is a complex field, since it is influenced by the legislation of several states. Laws in different states may have unforeseen interaction effects, which can be exploited by allowing multi-national companies to minimize and avoid taxes.

Thus, we created a knowledge graph of multi-national companies and their relationships. Many commonly known tax avoidance strategies can be formulated as subgraph queries to this graph, which allows for identifying companies using certain strategies. Moreover, we can identify anomalies in the graph which hint at potential tax avoidance strategies.

Query the Graph

Why don't you query for companies with headquarter in the United States and legal address in Cayman Islands?

WHERE {

?a tgp:headquartersAddressCountry tgc:US .

?a tgp:legalAddressCountry tgc:KY .

}

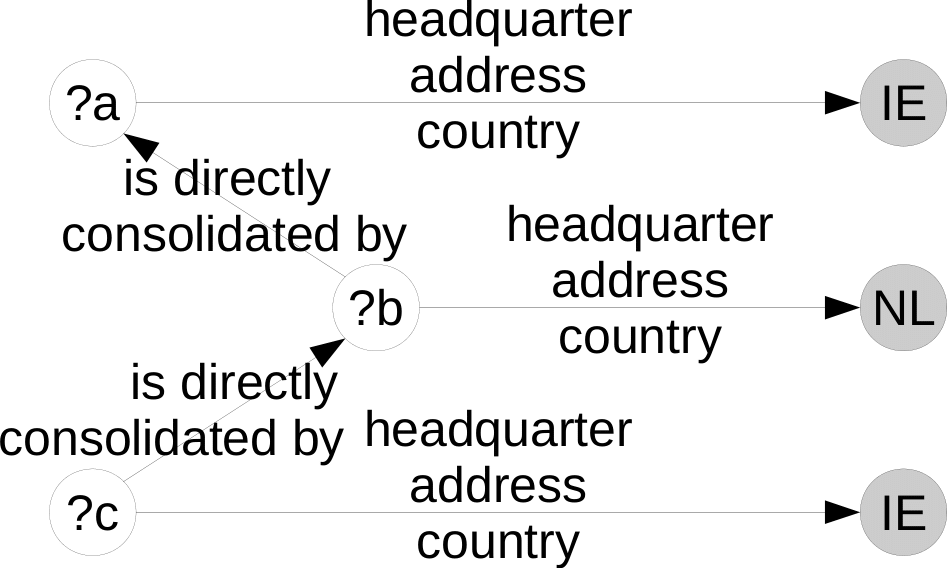

Alternatively, you can query for companies employing a structure called Duck-Rabbit Construct:

WHERE {

?b tgp:headquartersAddressCountry tgc:BM .

?b tgp:isUltimatelyConsolidatedBy ?a .

?c tgp:headquartersAddressCountry tgc:NL .

?c tgp:isDirectlyConsolidatedBy ?b .

?c tgp:legalForm tglf:54M6 .

}

You can also issue federated queries to pull in data from other knowledge graphs like Wikidata. This query uses the area of cities in Wikidata to compute the density of companies by headquarter and legal address in each city:

SELECT ?c ?count ?a (?count/?a as ?density) WHERE {

{ SELECT COUNT(?x) AS ?count ?c WHERE {

?x tgp:headquartersAddressCityID ?c .

}

GROUP BY ?c

HAVING(COUNT(?x)>1000)

}

?c owl:sameAs ?wdc .

SERVICE <https://query.wikidata.org/sparql> {

?wdc wdt:P2046 ?a

}

} ORDER BY DESC(?density)

Browse the Graph

We provide a Linked Open Data endpoint so that you can inspect all elements of the graph in the browser. Here are some examples:

Countries

Statistics

| Class | Count |

|---|---|

| Company | 1,491,143 |

| Country | 225 |

| City | 95,306 |

| Legal Form | 1,286 |

| Relation | Count |

|---|---|

| direct subsidiary | 87,020 |

| ultimate subsidiary | 96,465 |

Credits

TaxGraph is the result of a student project conducted at the Chair for Data Science at the University of Mannheim. The project was conducted by the students Niklas Lüdemann, Ageda Shiba, and Nikolaos Thymianis. The project was supervised by Christopher Ludwig, Nicolas Heist, and Heiko Paulheim.